Establishment of the Board. The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report.

Pdf Employee Share Ownership Plans A Review

17 Is there any overlap between copyright and other intellectual property rights such as design rights and database rights.

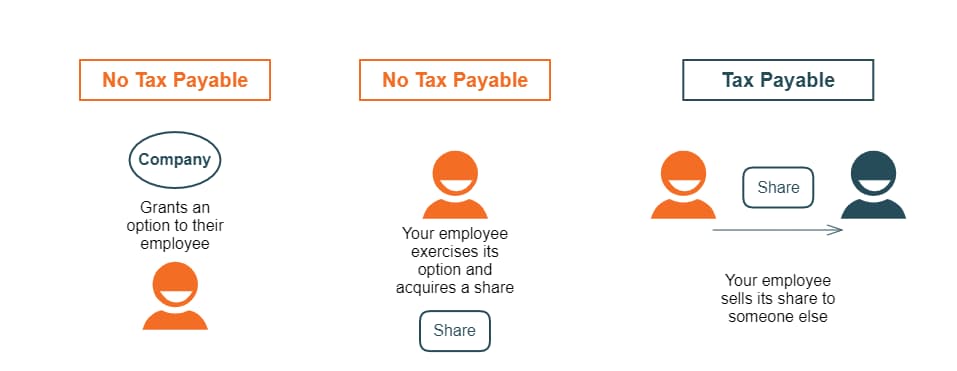

. The employee is taxed on restricted stock upon grant and on RSUs upon vesting may include personal assets tax. We can also take care of every facet of your employee share plan from implementation through to administration. PART II THE BOARD AND THE INVESTMENT PANEL.

Alternatively if you are a retiree of an employer offering health benefits through Mercer Marketplace 365 and are interested in enrolling in coverage or have questions regarding your current benefits please call 1 888 434. The remaining pension wealth can either be withdrawn in a lump sum on attaining the age of 60 or in a phased manner between age 60 and 70 at the option of the subscriber. Rule 2 Sub Rule 4 of the SEBI Guidelines defines Employee Stock Purchase Scheme as a scheme where the company offers shares to its employees as a part of a public issue or otherwise.

The employer contribution is taxed at the employees marginal tax rate so the actual amount the employee receives in their account is between 201 and 2685. And with the help of 19 partners around. Death due to any cause - In such an unfortunate event option will be available to the nominee to receive 100 of the NPS pension wealth in lump sum.

From the start of the scheme until May 2015 those who joined KiwiSaver received a 1000 tax-free kick start to their KiwiSaver account from the government. A survey was conducted by using a questionnaire through online survey form for gathering information about Employee Loyalty relating it to Organizational Performance and taking the respondents. REQUEST A FREE CONSULTATION.

28 of the respondents said that they strongly agreed that their manager helped them succeed and 18 said that they agreed. If you have exited the transaction acknowledgement screen go to the Payment History tab under Pay Module in Dashboard click on the date of the transaction and click on the Print Receipt button in the Payment Details page at. Advising companies on how to structure ESOS schemes.

At IKEA did your manager help you succeed. Malaysia has a well-developed infrastructure. We can create a custom-made share option scheme that fits your business needs.

Total monthly remuneration RM 500000. Malaysia beat out countries like Australia and the United Kingdom to claim this spot. A bicycle-sharing system bike share program public bicycle scheme or public bike share PBS scheme is a shared transport service in which bicycles are made available for shared use to individuals on a short-term basis for a price or free.

Looking to incentivise your workforce with an Employee Stock Option Plan. Every month both the employer and employee will have to contribute to the employees CPF account. A company can only do so when it has been listed.

For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. An ESOP Scheme for a listed company is called Employee Stock Purchase Scheme ESPS. Net PCB RM 500000 x 28.

The employee is subject to a flat tax of 15 percent on any net gain resulting from the sale of the shares by Argentine Tax residents or alternatively 135 percent on the gross sale price by non-residents. Indeeds Work Happiness survey asked over 2039 current and former employees whether their manager at IKEA helped them succeed. Advising clients on terms and conditions of employee share option scheme.

The most commonly chosen option was I dont know. If you are an active employee and have questions regarding your employer health benefits offered through Mercer Marketplace 365 please call 1 855 963 7237. In Malaysia the protection of industrial designs is governed by the Industrial Designs Act 1996 and the Industrial Designs Regulations 1999 ID ActWhen the ID Act came into force in 1999 amendments were made to the Act which.

Many bike share systems allow people to borrow a bike from a dock and return it at another dock belonging to the same system. Selangor Malaysia Mon-Fri 9am-6pm T 6 03 7887 2702 F 6 03 7887 2703 M 6 017 887 2702. Malaysia has a strong educated workforce and English is widely used as a business language.

Yes simply click on share button in the transaction acknowledgement screen after every successful transaction. The CPF contribution rates vary according to the age group the employee belongs to. Employees share option scheme if employee opts for PCB deduction Tax borne by employer Gratuity Compensation for loss of employment Ex-gratia.

For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary. For an employee whose monthly wage is more than 750 please refer to CPF Contribution Rates for more information.

What Is An Employee Share Plan Esas Vs Espp Boardroom

Employee Stock Option Plan Esop Employee Stock Option Scheme India

Valuation Of Options Under Esop Scheme Ipleaders

Top 5 Benefits Of An Employee Share Plan Esop Boardroom

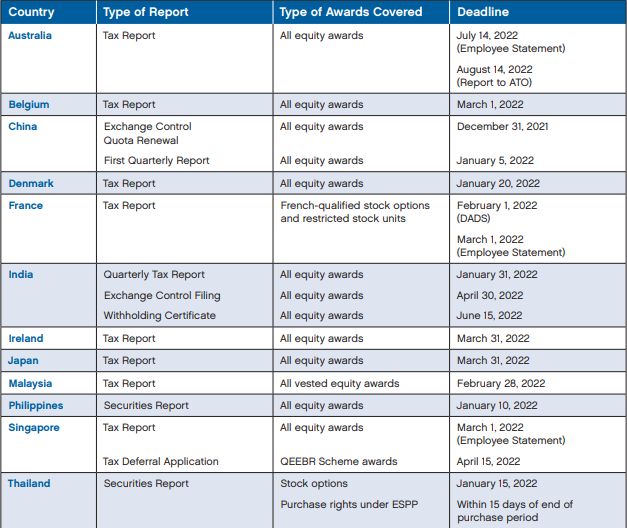

Employee Stock Plans International Reporting Requirements Employee Rights Labour Relations Worldwide

![]()

Essentials Of An Employee Stock Option Plan Esop Scheme Ipleaders

5 Points To Consider When Implementing An Employee Share Option Plan Employee Benefits Compensation Australia

Employee Stock Option Scheme Esop And Sweat Equity Shares

Esos What You Need To Declare When Filing Your Income Tax

Employee Share Option Scheme Esos

Voluntary Mutual Separation Schemes Vss Mss

Employee Stock Option Plan Esop In Malaysia The Overview

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

Rules Regarding Issuance Of Stock Option Plans Ipleaders

Employee Stock Option Plan Esop In Malaysia The Overview

Employee Stock Options Basics Malaysia Donovan Ho

Overview Of Employee Shares Options Scheme For Startups

Malaysia Employee Share Option Scheme Esos System Open Soft Systems

What Is An Employee Share Plan Esas Vs Espp Boardroom